On-Campus

Hybrid

- New tuition rate from Summer 2025: $590/course

- Quarterly tuition: $2,000 including registration and facility fee.

- PSU is authorized under Federal Law to enroll non-immigrant alien students (F-1) and to issue I-20s.

Requirement for the AICPA Exam in California

Education Requirement for the AICPA Uniform Exam by California Board of Accountancy

- Bachelor degree

- 24 semester units of Accounting subjects

(such as Accounting, Auditing, Financial reporting, External & Internal reporting, Financial statement and analysis, and Taxation, etc.) - 24 semester units of Business related subjects

(such as Business Administration, Business Management, Business Communication, Finance, Economics, Marketing, Business Law, Mathematics, Statistics, Computer Science, and Information System, etc.)

Certificate & License

| Pathway 1 | Pathway 2 | |

| Education Requirements |

|

|

| Certificate | Pass 4 subjects | Pass 4 subjects |

| License | Minimum 2 years experience under California CPA Licensee required Attest 500 hours – Optional | Minimum 1 years experience under California CPA Licensee required Attest 500 hours – Optional |

Foreign Education

If you have completed your Bachelor’s degree other than in the United States, your degree and/or your transcripts (course by course) should be evaluated by the evaluation agencies approved by California Board of Accountancy. More information can be found at http://www.dca.ca.gov/cba/

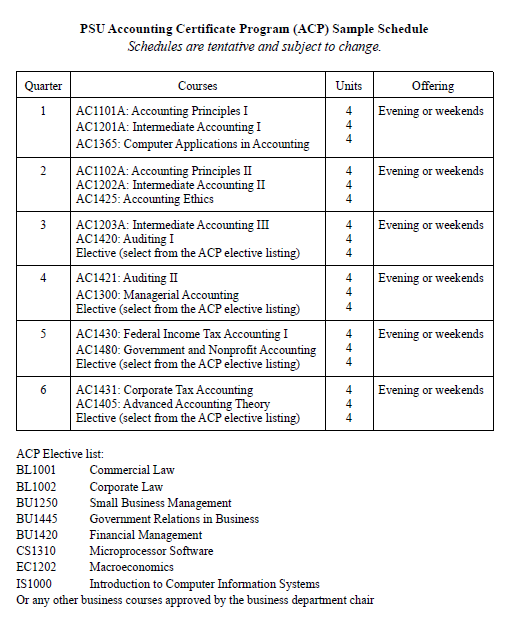

Sample Schedule

Course List

| AICPA Exam Subjects Related Courses | PSU Accounting Courses |

| Financial Accounting & Report (FAR) |

|

| Regulation (REG) |

|

| Business Environment & Concepts (BEC) |

|

| Auditing & Attestation (AUD) |

|

| Ethics and Practical Accounting Courses | |

| Ethics Requirement |

|

| Practical Accounting |

|